(1) | This column reflects restricted shares and restricted share units awarded2020. No options were granted to non-employee directors in 2020 and no director had any options outstanding or deferred for each Director as of December 31, 2020. | | Award Shares/Units and RSU | | | Deferrals Outstanding at | | Name | | December 31, 2018.2020 | (2)Donald W. Blair | No options were granted to non-employee directors in 2018. | | 77,723 | | Leslie A. Brun | | | 16,196 | | Stephanie A. Burns | | | 76,661 | | Richard T. Clark | | | 67,232 | | Robert F. Cummings, Jr. | | | 200,930 | | Deborah A. Henretta | | | 80,066 | | Daniel P. Huttenlocher | | | 38,622 | | Kurt M. Landgraf | | | 170,887 | | Kevin J. Martin | | | 60,032 | | Deborah D. Rieman | | | 124,586 | | Hansel E. Tookes II | | | 111,896 | | Mark S. Wrighton | | | 83,203 |

| CORNING 2021 PROXY STATEMENT | 45 |

CORNING2019 PROXY STATEMENT | 39 |

Table of Contents Stock Ownership

Information | |  |

Stock Ownership

Information Stock Ownership Guidelines We believe in the importance of equity ownership by directors and executive management as an effectivea direct link to shareholders, and require all directors, named executive officers (NEOs), and non-NEO executive management to achieve the required levels of ownership under our stock ownership guidelines within five years of their election, appointment or designation. Restricted, and direct and indirectly owned shares, and current and deferred restricted stock units, each count toward our stock ownership guidelines. An NEO who falls below the ownership requirement for any reason will have up to three years to return to the required minimum ownership level. All directors and NEOs who have been so for five years or more currently comply with ourthe guidelines. In December 2020, we increased the stock ownership guidelines applicable to non-NEO executive senior leadership team members as a multiple of base salary from 1.5 to 3 in line with all NEOs other than the CEO whose multiple remains 6 times base salary. Recently-appointed senior leadership team members will have five years to comply with the new guidelines. | DIRECTORS | | CEO | | OTHER NEOs and

SENIOR LEADERSHIP

TEAM MEMBERS | | | NON-NEO SENIOR

MANAGEMENT | | | | | | | | | | 5X

Annual Cash Retainer | | 6X

Base Salary | | 3X

Base Salary | | 1.5X

Base Salary

|

Our directors and executive management are also subject to our anti-hedging and anti-pledging policies. For further information, see “Anti-Hedging Policy” and “Anti-Pledging Policy” both on page 56.65. Section 16(a) Beneficial Ownership Reporting Compliance

SEC rules require disclosure of those directors, officers, and beneficial owners of more than 10% of our common stock who fail to timely file reports required by Section 16(a) of the Securities Exchange Act of 1934 during the most recent fiscal year. Based on review of reports furnished to us and written representations that no other reports were required during the fiscal year ended December 31, 2018, all Section 16(a) filing requirements were met.

4046 | CORNING2019 2021 PROXY STATEMENT |

Table of Contents Stock Ownership Information Beneficial Ownership Table | As of December 31, 2018 | | Shares Directly or

Indirectly Owned(1)(2)(3) | | | Stock Options

Exercisable

Within 60 Days | | Restricted Share

Units Vesting

Within 60 Days | | (A)

Total Shares

Beneficially

Owned | | | Percent

of Class | | (B)

Restricted Share

Units Not Vesting

Within 60 Days(4) | | Total of

Columns

(A) + (B) | | The Vanguard Group | | — | | | — | | — | | 62,711,606 | (5) | | 7.83 | | — | | — | | BlackRock, Inc. | | — | | | — | | — | | 53,217,738 | (6) | | 6.60 | | — | | — | | T. Rowe Price Associates, Inc. | | — | | | — | | — | | 43,683,804 | (7) | | 5.40 | | — | | — | | State Street Corporation | | — | | | — | | — | | 40,385,093 | (8) | | 5.00 | | — | | — | | Donald W. Blair | | 17,243 | | | 0 | | 0 | | 17,243 | | | * | | 38,594 | | 55,837 | | Leslie A. Brun | | 0 | | | 0 | | 0 | | 0 | | | * | | 2,812 | | 2,812 | | Stephanie A. Burns | | 49,288 | | | 0 | | 0 | | 49,288 | | | * | | 23,100 | | 72,388 | | John A. Canning, Jr. | | 139,150 | | | 1,323 | | 0 | | 140,473 | | | * | | 51,794 | | 192,267 | | Richard T. Clark | | 41,962 | | | 0 | | 0 | | 41,962 | | | * | | 11,447 | | 53,409 | | Robert F. Cummings, Jr. | | 151,199 | | | 2,345 | | 0 | | 153,544 | | | * | | 113,106 | | 266,650 | | Deborah A. Henretta | | 25,965 | | | 0 | | 0 | | 25,965 | | | * | | 35,033 | | 60,998 | | Daniel P. Huttenlocher | | 13,910 | | | 0 | | 0 | | 13,910 | | | * | | 11,447 | | 25,357 | | Kurt M. Landgraf | | 62,957 | | | 0 | | 0 | | 62,957 | | | * | | 94,130 | | 157,087 | | Kevin J. Martin | | 31,506 | | | 0 | | 0 | | 31,506 | | | * | | 11,447 | | 42,953 | | Deborah D. Rieman | | 100,813 | | | 2,345 | | 0 | | 103,158 | | | * | | 11,447 | | 114,605 | | Hansel E. Tookes II | | 96,863 | | | 2,345 | | 0 | | 99,208 | | | * | | 11,447 | | 110,655 | | Mark S. Wrighton | | 63,743 | | | 2,345 | | 0 | | 66,088 | | | * | | 11,447 | | 77,535 | | Wendell P. Weeks | | 800,371 | (9) | | 488,003 | | 3,182 | | 1,291,556 | | | * | | 246,598 | | 1,538,154 | | R. Tony Tripeny | | 48,939 | | | 102,663 | | 993 | | 152,595 | | | * | | 51,006 | | 203,601 | | James P. Clappin | | 90,836 | | | 36,664 | | 1,065 | | 128,565 | | | * | | 62,750 | | 191,315 | | Lawrence D. McRae | | 137,456 | | | 162,943 | | 1,081 | | 301,480 | | | * | | 66,321 | | 367,801 | | David L. Morse | | 35,953 | | | 72,365 | | 1,033 | | 109,351 | | | * | | 61,830 | | 171,181 | | All Directors and Executive | | | | | | | | | | | | | | | | | | Officers as a group (25 persons) | | 2,162,918 | (10)(11) | | 1,468,167 | | 10,995 | | 3,642,080 | | | * | | 1,214,102 | | 4,856,182 |

| As of December 31, 2020 | | Shares Directly or

Indirectly

Owned(1)(2)(3) | | Stock Options

Exercisable

Within 60 Days | | Restricted Stock

Units Vesting

Within 60 Days | | (A)

Total Shares

Beneficially

Owned | | Percent

of Class | | (B)

Restricted Stock

Units Not Vesting

Within 60 Days(4) | | Total of

Columns

(A) + (B) | | Samsung Display Co., Ltd. | | — | | — | | — | | 115,000,000 | (5) | 13.0 | % | — | | — | | The Vanguard Group | | — | | — | | — | | 84,650,440 | (6) | 11.08 | % | — | | — | | BlackRock, Inc. | | — | | — | | — | | 51,887,522 | (7) | 6.8 | % | — | | — | | Wellington Management Group LLP | | — | | — | | — | | 49,637,646 | (8) | 6.50 | % | — | | — | | State Street Corporation | | — | | — | | — | | 39,034,680 | (9) | 5.11 | % | — | | — | | Donald W. Blair | | 17,243 | | | | | | 17,243 | | * | | 60,480 | | 77,723 | | Leslie A. Brun | | 0 | | | | | | 0 | | * | | 16,196 | | 16,196 | | Stephanie A. Burns | | 56,888 | | | | | | 56,888 | | * | | 36,127 | | 93,015 | | Richard T. Clark | | 41,962 | | | | | | 41,962 | | * | | 25,270 | | 67,232 | | Robert F. Cummings, Jr. | | 151,199 | | | | | | 151,199 | | * | | 136,244 | | 287,443 | | Roger W. Ferguson, Jr. | | — | | | | | | — | | — | | — | | — | | Deborah A. Henretta | | 25,965 | | | | | | 25,965 | | * | | 54,101 | | 80,066 | | Daniel P. Huttenlocher | | 13,910 | | | | | | 13,910 | | * | | 24,712 | | 38,622 | | Kurt M. Landgraf | | 62,957 | | | | | | 62,957 | | * | | 107,930 | | 170,887 | | Kevin J. Martin | | 31,506 | | | | | | 31,506 | | * | | 28,526 | | 60,032 | | Deborah D. Rieman | | 100,813 | | | | | | 100,813 | | * | | 24,973 | | 125,786 | | Hansel E. Tookes II | | 96,863 | | | | | | 96,863 | | * | | 25,033 | | 121,896 | | Mark S. Wrighton | | 66,088 | | | | | | 66,088 | | * | | 24,890 | | 90,978 | | Wendell P. Weeks | | 740,125 | (10) | 556,106 | | 5,449 | | 1,301,680 | | * | | 305,428 | | 1,607,108 | | R. Tony Tripeny | | 66,204 | | 138,775 | | 1,509 | | 206,488 | | * | | 73,577 | | 280,065 | | James P. Clappin | | 80,324 | | 110,860 | | 1,584 | | 192,768 | | * | | 79,207 | | 271,975 | | Lawrence D. McRae | | 161,960 | | 183,714 | | 1,608 | | 347,282 | | * | | 80,996 | | 428,278 | | Eric S. Musser | | 72,201 | | 0 | | 1,717 | | 73,918 | | * | | 80,360 | | 154,278 | | All Directors and Executive Officers as a group (33 persons) | | 2,052,665 | (11)(12) | 1,610,235 | | 21,130 | | 3,684,030 | | | | 1,972,703 | | 5,656,666 |

| | | * | Less than 0.50% | | (1) | Includes shares of common stock subject to forfeiture and restrictions on transfer, granted under Corning’s Incentive Stock Plans. | | (2) | Includes shares of common stock subject to forfeiture and restrictions on transfer, granted under Corning’s Restricted Stock Plans for non-employee directors. | | (3) | Includes shares of common stock held by The Bank of New York Mellon Corporation as the trustee of Corning’s Investment Plans for the benefit of the members of the group, who may instruct the trustee as to the voting of such shares. If no instructions are received, the trustee votes the shares in the same proportion as it votes the shares for which instructions were received. The power to dispose of shares of common stock is also restricted by the provisions of the plans. The trustee holds for the benefit of Messrs. Weeks, Tripeny, Clappin, McRae and Dr. Morse,Musser, and all executive officers as a group, the equivalent of 12,577, 0, 2,312, 6,740,13,278; 0; 2,440; 7,115; 0 and 24,65428,021 shares of common stock, respectively. It also holds for the benefit of all employees who participate in the plans the equivalent of 12,059,5629,939,698 shares of common stock (being 1.52%1.30% of the class). | | (4) | Restricted ShareStock Units represent the right to receive unrestricted shares of common stock upon the lapse of restrictions, at which point the holders will have sole investment and voting power. Restricted ShareStock Units that will not vest within 60 days of the date of this table are not considered beneficially owned for purposes of the table and therefore are not included in the Total Shares Beneficially Owned column because the holders are not entitled to voting rights or investment control until the restrictions lapse. However, ownership of these RSUs further aligns our Directors and Executive Officers’ interests with those of our shareholders. | | (5) | Samsung Display Co., Ltd. (Samsung) is the holder of Corning’s preferred stock, which became convertible as of January 15, 2021 but has not yet been converted. The table reflects the beneficial ownership of Samsung on an as-converted basis, according to a Schedule 13G filed by Samsung with the SEC on February 2, 2021, reflecting ownership of the unconverted preferred stock as of December 31, 2020. If Samsung’s preferred stock were converted, using the information as of December 31, 2020, Samsung would have sole voting power and/or sole dispositive power with respect to 115,000,000 shares, shared voting power and/or shared dispositive power with respect to 0 shares, and would beneficially own 13.0% of our common stock. | | (6) | Reflects shares beneficially owned by The Vanguard Group (Vanguard), according to a Schedule 13G/A filed by Vanguard with the SEC on February 11, 2019,10, 2021, reflecting ownership of shares as of December 31, 2018.2020. Vanguard has sole voting power and/or sole dispositive power with respect to 61,552,33181,299,646 shares and shared voting power and/or shared dispositive power with respect to 1,159,275.3,350,794. According to the Schedule 13G/A, Vanguard beneficially owned 7.83%11.08% of our common stock (on an as-converted basis as of December 31, 2018.2020). | (6)(7) | Reflects shares beneficially owned by BlackRock, Inc. (BlackRock), according to a Schedule 13G/A filed by BlackRock with the SEC on February 2, 2019,January 29, 2021, reflecting ownership of shares as of December 31, 2018.2020. BlackRock has sole voting power and/or sole dispositive power with respect to 53,217,73851,887,522 shares and shared voting power and/or shared dispositive power with respect to 0 shares. According to the Schedule 13G/A, BlackRock beneficially owned 6.6%6.8% of our common stock as of December 31, 2018.2020. | (7)(8) | Reflects shares beneficially owned by T. Rowe Price Associates, Inc. (T. Rowe Price), according to aBased solely on Schedule 13G jointly filed by T. Rowe Price with the SEC on February 14, 2019, reflecting ownership4, 2021 by Wellington Management Group LLP (“Wellington Management”), Wellington Group Holdings LLP (“Wellington Holdings”), Wellington Investment Advisors Holdings LLP (“Wellington Advisors”) and Wellington Management Company LLP (“Wellington Company”). These shares are owned of shares asrecord by clients of December 31, 2018. T. Rowe Price has sole votingWellington Holdings, Wellington Investment Advisors LLP, Wellington Management Global Holdings, Ltd., Wellington Company, Wellington Management Canada LLC, Wellington Management Singapore Ptd Ltd, Wellington Management Hong Kong Ltd, Wellington Management International Ltd, Wellington Management Japan Ptd Ltd, and Wellington Management Australia Pty Ltd (collectively, the “Wellington Investment Advisors”). Wellington Advisors controls directly, or indirectly through Wellington Management Global Holdings, Ltd., the Wellington Investment Advisors. Wellington Advisors is owned by Wellington Holdings and Wellington Holdings is owned by Wellington Management. The clients of the Wellington Investment Advisors have the right to receive, or the power and/to direct the receipt of, dividends from, or sole dispositivethe proceeds from the sale of, such securities. No such client is known to have such right or power with respect to 43,683,804more than five percent of this class of securities. Each of Wellington Management and Wellington Holdings has shared voting power over 45,576,124 shares and shared dispositive power over 49,637,646 shares. Wellington Advisors has shared voting power and/orover 45,576,124 shares and shared dispositive power with respect to 0. According to the Schedule 13G, T. Rowe Price beneficially owned 5.4%over 49,637,646 shares. Wellington Company has shared voting power over 44,301,256 shares and shared dispositive power over 45,657,685 shares. Wellington Management, Wellington Holdings, and Wellington Advisors have shared beneficial ownership of 6.50%, and Wellington Management has shared beneficial ownership of 5.98%, of our common stock as of December 31, 2018.30, 2020. | (8)(9) | Reflects shares beneficially owned by State Street Corporation (State Street), according to a Schedule 13G filed by State Street with the SEC on February 14, 2019,8, 2021, reflecting ownership of shares as of December 31, 2018.2020. State Street has sole voting power and/or sole dispositive power with respect to 0 shares and shared voting power and/or shared dispositive power with respect to 40,385,093.39,034,680. According to the Schedule 13G, State Street beneficially owned 5.0%5.11% of our common stock as of December 31, 2018.2020. | (9)(10) | Includes 787,794726,847 shares held by a revocable trust of which Mr. Weeks is the beneficiary. He currently has no voting authority over these shares. | (10)(11) | Does not include 28,74519,631 shares owned by the spouses and minor children of certain executive officers and directors as to which such officers and directors disclaim beneficial ownership. | (11)(12) | As of December 31, 2018,2020, none of our directors or executive officers have pledged any such shares. |

| CORNING 2021 PROXY STATEMENT | 47 |

CORNING2019 PROXY STATEMENT | 41 |

Table of Contents Proposal 2

Advisory Approval of Executive Compensation

(Say on Pay) | |  |

Proposal 2 Advisory Approval of Executive Compensation

(Say on Pay) Our Board of Directors requests that shareholders approve the compensation of our Named Executive Officers (NEOs), pursuant to Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), as disclosed in this proxy statement, which includes the Compensation Discussion and Analysis, the Summary Compensation Table and the supporting tabular and narrative disclosure on executive compensation. This

While this vote is advisory and not binding on the Company, but the Board of Directors values shareholder opinion and will consider the outcome of the vote in determining our executive compensation programs. Say on Pay Proposal Our Board maintains a “pay for performance” philosophy that forms the foundation for all of the Compensation Committee’s decisions regarding executive compensation. In addition, our compensation programs are designed to facilitate strong corporate governance, foster collaboration and support our short- and long-term corporate strategy.strategies. The Compensation Discussion and Analysis portion of this proxy statement contains a detailed description of our executive compensation philosophy and programs, the compensation decisions the Compensation Committee has made under those programs and the factors considered in making those decisions, including 20182020 Company performance and the direct alignment of pay with performance, focusing on the compensation of our NEOs. Our shareholders have affirmed their support of our executive pay programs in our outreach discussions and in last year’stheir ongoing support of our Say on Pay results.proposals. We believe that we have created a compensation program deserving of shareholder support. For these reasons, the Board of Directors recommends that shareholders vote in favor of the resolution: RESOLVED, that on an advisory non-binding basis, the total compensation paid to the Company’s Named Executive Officers (CEO, CFO and three other most highly compensated executives), as disclosed in thethis proxy statement for the 2019 Annual Meeting of Shareholders pursuant to the SEC’s executive compensation disclosure rules including(which includes the Compensation Discussion & Analysis, the Summary Compensation Table, and the supporting tabular and related narrative disclosure on executive compensation,compensation) is hereby APPROVED.   | FOR | Our Board unanimously recommends a vote FOR the advisory approval of our executive compensation as disclosed in this proxy statement. |

4248 | CORNING2019 2021 PROXY STATEMENT |

Table of Contents Compensation Discussion

& Analysis | |  |

Compensation Discussion

& Analysis This Compensation Discussion & Analysis (CD&A) presents Corning’s executive compensation for 2018,2020, including the compensation for our Named Executive Officers (NEOs), and describes how this compensation aligns with our pay for performance philosophy and supportsrecognizes achievement of corporate goals during the successchallenges of our Strategy and Capital Allocation Framework.the COVID-19 pandemic. OUR NEOs IN FISCAL YEAR 2020 WERE: OUR NEOs IN FISCAL YEAR 2018 WERE: | | Named Executive Officer | Role | Role | | Years in Role | | Years at Corning | | Wendell P. Weeks | | Chairman and Chief Executive Officer (CEO) and President | | 1416 Years as CEO

(12 (14 years as CEO/Chairman) | | 3638 years | | R. Tony Tripeny | | Executive Vice President and Chief Financial Officer | | 35 Years | | 3436 years | | James P. Clappin | Second Vice Chairman and Strategic Advisor to the CEO | 1 Year (9 Years as Executive Vice President, Corning Glass TechnologiesPresident) | | 8 Years | | 3941 years | | Lawrence D. McRae | | First Vice Chairman and Corporate Development Officer | | 35 Years as Vice Chairman

(19 (21 years as Corporate Development Officer) | | 3436 years | David L. MorseEric S. Musser | | Executive Vice President and Chief TechnologyOperating Officer | 1 Year (5 years as Executive Vice President) | 6 Years | | 4335 years |

CD&A Table of Contents To assist shareholdersyou in finding important information, we call your attention to the following sections of the CD&A: | CORNING 2021 PROXY STATEMENT | 49 |

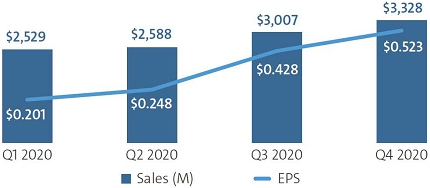

Table of Contents Compensation Discussion & Analysis Overview: How We Successfully Navigated a Challenging Year Our Response to the COVID-19 Pandemic: Prioritizing our People While Ensuring Financial Health 2020 was an incredibly difficult year as the world faced the COVID-19 pandemic, ongoing economic uncertainty, and social unrest. Throughout the year, management and the Board focused on keeping our employees safe and retaining our talent, protecting our financial health and preserving the trust of Corning stakeholders. The actions we took resulted in a stronger balance sheet, record fourth-quarter sales, and free cash flow generation of $948 million for the year, all while retaining and supporting the talent that drives future growth at Corning. Special Compensation Committee Actions in 2020 To address the pandemic’s significant economic impact, our Compensation Committee approved certain actions under our Shared Sacrifice, Shared Opportunity (SSSO) program. The actions were multi-faceted with the primary goals to ensure financial health and stability of the Company and retain the talent we would need as we returned to growth. The Compensation Committee approved the following actions under the SSSO program: | • | Cancelling 2020 annual salary reviews for global salaried employees; | | | | • | Implementing certain salary actions to conserve cash and preserve talent (including exchanging portions of base-salaries for options and restricted stock units applicable to approximately 10,000 global salaried employees for the second half of the year); and | | | | • | Capping 2020 PIP payouts at 100% of target and replacing cash bonuses with Restricted Stock Units (RSUs) that will vest over 3 years. |

Additionally, the Committee used its discretion to exclude the impact of the incremental revenue from the Hemlock consolidation in our 2020 financial results for purposes of the Long-Term Incentive (LTI) Plan performance results, resulting in a lower 2020 performance score. We believe these and other decisive actions taken were key to our success in 2020. As part of our shareholder engagement process in late 2020, we discussed these innovative compensation actions taken to preserve cash and gathered feedback, which was very positive. For more information on these and other steps taken in response to the pandemic, refer to “Impact of COVID-19 on Compensation and Benefits” on page 55. Performance Goal Setting As we entered 2020, our international operations–particularly a new Display plant coming online in Wuhan, China–provided us with early visibility into the COVID-19 pandemic. We quickly realized that the impact would be significant and the length of the downturn would be uncertain. In the first half of 2020, the severe global economic crisis resulting from the pandemic impacted nearly all of our end markets and key customers, such as automakers, which in turn rapidly impacted our own operations. The Board and management quickly recognized that our growth plan for the year was at risk and approved goals to protect shareholder value. As a result, the Compensation Committee and the Board established primary goals of retaining the talent we would need as economies recovered and we returned to growth, ensuring financial strength, and maintaining stability of the company. The Committee established financial goals designed to drive second-half growth and our successful execution of these decisive actions is evidenced in our results. While first-half sales were down 7% year-over-year, second-half sales were up 9% year-over-year–and up 24% sequentially. Our flexibility and strong execution allowed us to meet the large and unpredictable swings in client demand. Importantly, in addition to growing sales in the second half of the year, we expanded margins and generated almost $1 billion of free cash flow, a key goal in the Long-Term Incentive Plan discussed below. | 50 | CORNING 2021 PROXY STATEMENT |

Table of Contents Compensation Discussion & Analysis For additional detail, refer to “2020 Performance Highlights: Overcoming Current Challenges and Driving Second-Half Growth” on page 7. Implementing Shareholder Feedback Notwithstanding the unique and challenging macro environment, Corning continued to implement positive changes in response to shareholder feedback. Based on feedback received in 2019, the Compensation Committee approved a redesign of our LTI Plan starting in 2020. As a result, we adjusted the LTI Plan to: | • | Increase the overall portion tied to corporate financial performance from 60% to 70%, by introducing Performance Stock Units (PSUs) (and eliminating stock options). | | | | • | Reduce the cash component (Cash Performance Units or CPUs) from 60% to 25%; | | | | • | Increase the equity component (PSUs and RSUs) from 40% to 75%; and |

The LTI Plan is more fully explained under “Our Long-Term Incentives” on page 54. No Change in CEO Target Pay in 2020 There were no changes to the CEO’s target pay in 2020 as compared to 2019. However, the LTI Plan design changes noted above, implemented in response to shareholder feedback, make year-over-year pay comparisons in the Summary Compensation Table difficult. Our 2019 performance was significantly below-target (Performance Incentive Plan (PIP) at 24% and LTI CPUs at 62%) and resulted in below-target payouts in 2019. Performance greatly improved in 2020, with strong free cash flow supporting results and fortifying the Company’s balance sheet amidst continued business volatility. In 2020, the cash PIP was eliminated and PIP-PSUs were capped at 100% of target. However, the CPU and PSU percentage of target earned in 2020 was significantly above-target at 181% because the Company significantly exceeded the aggressive free cash flow goal. So while the total CEO pay target established by the Compensation Committee was the same for both 2019 and 2020, the significant improvement in 2020 performance versus below-target 2019 performance resulted in a significant increase in 2020 compensation. This is exactly how the Compensation Committee designed our variable compensation programs to work. Payouts under the LTI Plan are dependent on our average performance over the applicable 3-year performance period, as well as impacted by the 3-year ROIC modifier. Our 3-year performance periods and the 3-year ROIC modifier ensure the alignment of pay and performance over these periods. For example, above-target performance in 2018, significantly below-target performance in 2019 and significantly above-target performance in 2020, reduced by 10% upon the application of the 3-year ROIC modifier, resulted in the 2020 CPU award to be paid out at 112% of target, aligning pay with performance for the 2018-2020 period. For further explanation, refer to the notes at the top of the “Summary Compensation Table” on page 67. | CORNING 2021 PROXY STATEMENT | 51 |

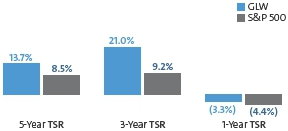

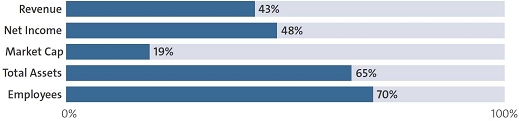

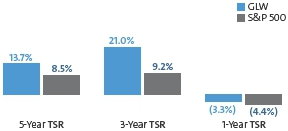

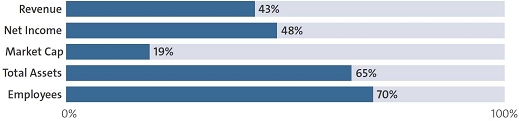

Table of Contents Compensation Discussion & Analysis Corning’s TSR Performance Corning’s Total Shareholder Return (TSR), which consists of stock price appreciation and reinvestment of common dividends, is shown below for 1-, 3- and 5-year periods. Despite the financial challenges of 2019, and the challenges of the pandemic in 2020, Corning’s 1-, 3- and 5-year TSR results reflect the strong foundation built during the 2016-2019 Strategy and Capital Allocation Framework which supported the Company through the challenges of both 2019 and 2020, resulting in the Company outperforming the S&P 500 Index for both the 1-year and 5-year periods ending December 31, 2020. | 2020 TOTAL SHAREHOLDER RETURN | | ANNUALIZED TOTAL SHAREHOLDER RETURN | | December 31, 2019 through December 31, 2020 | | As of year-end 2020 | | | |  | |  | | Source: Bloomberg | | Source: Bloomberg |

| • | Corning’s 1-year TSR performance is at the 76th percentile of the S&P 500; | | | | • | Corning’s 3-year TSR performance is at the 41st percentile of the S&P 500; and | | | | • | Corning’s 5-year TSR performance is at the 62nd percentile of the S&P 500. |

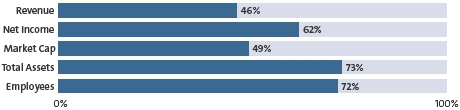

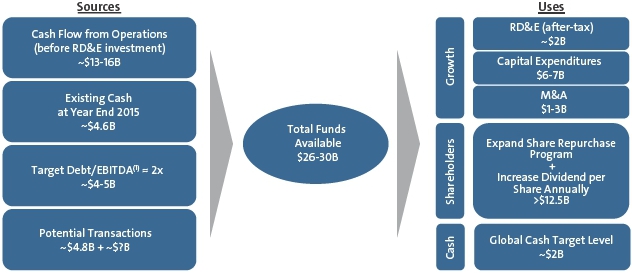

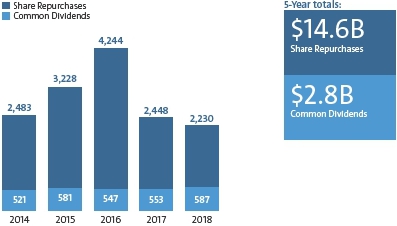

Over the past 3 years, Corning has: | • | Increased Core Net Sales by 12%; | | | | • | Generated $7.6 billion of adjusted operating cash flow and $2.0 billion of free cash flow; and | | | | • | Returned $5.1 billion to shareholders in dividends and share repurchases. |

| 52 | CORNING 2021 PROXY STATEMENT |

Table of Contents Compensation Discussion & Analysis Executive Summary

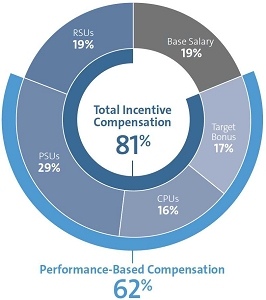

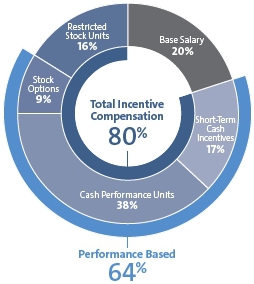

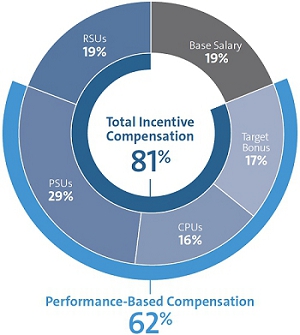

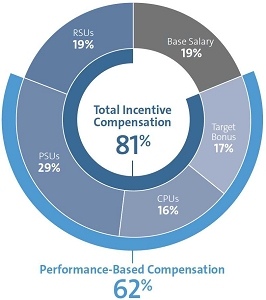

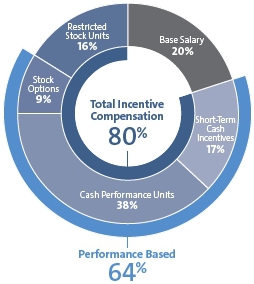

Executive Compensation Philosophy Our compensation program is designed to attract and retain the most talented employees within our industry segments and to motivate them to perform at the highest level while executing on our Strategy and Capital Allocation Framework.strategic priorities. In order to retain and motivate this caliber of talent, the Compensation Committee (the Committee) is committed to promoting a performance-based and team-based culture. Rewards areCompensation is tied to financial metrics thatdeveloped to incent management to successfully deliver on the Strategy and Capital Allocation Frameworkour strategic priorities and our commitments to our shareholders.Our executive compensation is directly aligned with our Company performance. 2020 Target Compensation Components | CEO | | ALL OTHER NEOs |  | |  |

Our Short-Term Incentives Short-Term Incentives*

(Paid in Cash) |  | |  |

| | | * | In 2020 as part of SSSO, cash PIP was cancelled and replaced with an equivalent target performance stock unit grant (PIP-PSUs) for NEOs (RSUs for other executives), based on pre-established core net sales and core earnings per share, capped at 100%, and subject to further vesting over three years. |

| CORNING 2021 PROXY STATEMENT | 53 |

CORNING2019 PROXY STATEMENT | 43 |

Table of Contents Compensation Discussion & Analysis Target Total Compensation

CEO | | ALL OTHER NEOs | | | |  | |  |

Our Short- and Long-Term Incentives | Short-Term Incentives | (Paid in Cash) |  |  |

Long-Term Incentives | (CPU, RSU and Option Awards) |  |

44 | CORNING2019 PROXY STATEMENT |

Table of Contents

Compensation Discussion & Analysis

2018 Compensation Metrics

Our key compensation metrics are Core Earnings per Share (Core EPS), Core Net Sales and Adjusted Operating Cash Flow less CapEx. These metrics are designed to ensure the success of our Strategy and Capital Allocation Framework by improving profitability (Core EPS), incenting top line growth (Core Net Sales) and generating operating cash (Adjusted Operating Cash Flow less CapEx).

| CORE EPS | CORE NET SALES | ADJUSTED OPERATING

CASH FLOW LESS CAPEX | 2018 Actual Results | $1.78 | $11,398

million | $926

million | 2018 Score as %

of Target Payout | 116%

of target for 2018 | 155%for PIP

127%for CPUs*

of target for 2018 | 128%

of target for 2018 |

* The payout scales for CPUs and PIP differ; CPUs are capped at 150% and PIP is capped at 200%. Please see page 47 for more information.

Please see “Our 2018 Performance Highlights” on page 6 for more information about our Core Performance Measures and Appendix A to this proxy statement for a reconciliation of the non-GAAP measures we use in this proxy statement to the most directly comparable GAAP financial measures.

Core Earnings per Share (Core EPS), Core Net Sales and Adjusted Operating Cash Flow are non-GAAP financial measures used by our management to obtain a clearer view of Corning’s operating results. | | Accordingly, these Core Performance Measures form the basis for our compensation performance metrics. |

CORNING2019 PROXY STATEMENT | 45 |

Table of Contents

Compensation Discussion & Analysis

2018 Company Performance Overview

In 2018, we utilized our financial strength to continue our focus on innovation, advancing key programs across our market-access platforms to make progress in our Strategy and Capital Allocation Framework.

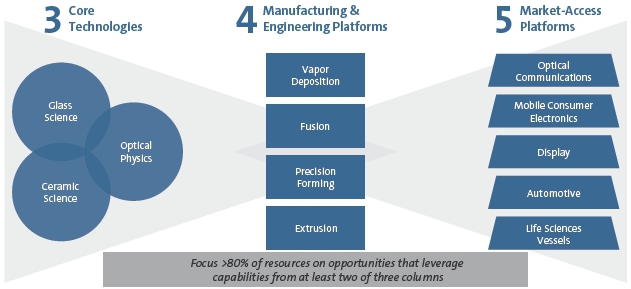

Highlights of progress across Corning’s market-access platforms include:

●Optical Communications:Secured contracts with industry leaders in the carrier and data center segments that will add significant sales in 2019 and beyond, introduced new products for the hyperscale data center and carrier environments and expanded market access through the acquisition of 3M’s Communication Markets Division

●Mobile Consumer Electronics:Extended the company’s leadership with the launch and adoption of Corning® Gorilla® Glass 6 as well as other cover glass and sensing technology innovations

●Automotive:Gained significant new sales and platform wins for gasoline particulate filters including reaching the production milestone of 1 million GPFs; increased pull for Gorilla Glass for Automotive solutions, particularly the industry’s first AutoGrade™ Glass Solutions for automotive interiors, reaching more than 55 platform wins to date

●Life Sciences Vessels:Increased shipments of Corning Valor® Glass fourfold year over year, indicating progress toward certification across more pharmaceutical companies

●Display:Reached stable returns as the glass pricing environment continued to improve and Corning extended its global leadership by establishing the world’s first Gen 10.5 manufacturing facility

|

Please see “Our 2018 Performance Highlights” on page 6 and “Our Strategy and Capital Allocation Framework” on page 7 for additional information on Corning’s 2018 financial performance. |

2018 Performance and Compensation Alignment

Each year we set rigorous and challenging performance goals aligned with our strategic objectives. We continue to believe that top line growth, overall profitability, and the generation of operating cash flow are the most important measures to the successful execution of our Strategy and Capital Allocation Framework and delivery of long-term shareholder value.

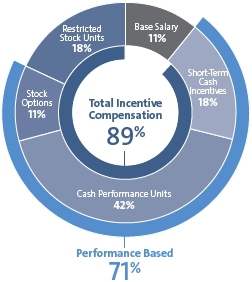

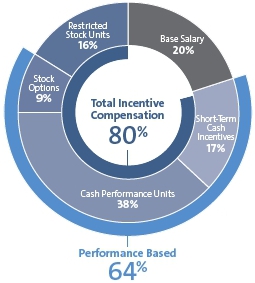

Approximately 89% of the CEO’s target total compensation (excluding employee benefits and perquisites) and 80% of the other NEOs’ target total compensation (excluding employee benefits and perquisites) is variable and depends upon our operating performance or is linked to our stock price.

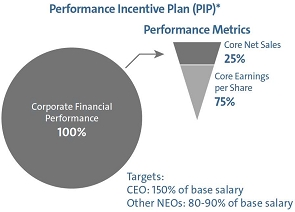

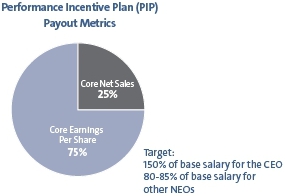

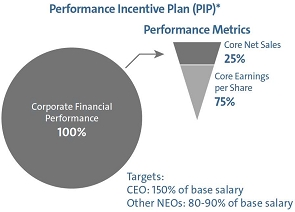

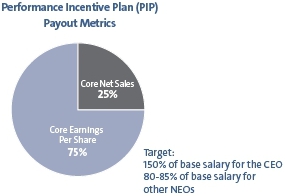

Net profitability and sales growth, both short- and long-term, drive success under our Strategy and Capital Allocation Framework. Accordingly, we have incentive measures linked to both short- and long-term outcomes. Our short-term incentives are cash payments composed of the Performance Incentive Plan (PIP) and the GoalSharing plan. Under each of the PIP and the GoalSharing plan, Core EPS (75% weight) measures bottom line profitability and Core Net Sales (25% weight) focuses on increasing top line growth. These two financial goals comprise 100% of PIP payouts for NEOs. Actual performance was above the established PIP targets for 2018, with the blended result being a payout of 126% of PIP target.

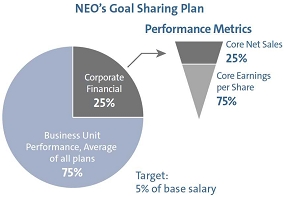

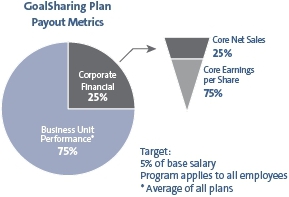

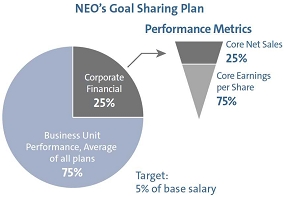

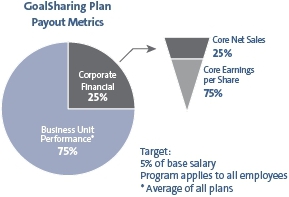

GoalSharing is a company-wide plan that rewards our workforce for the Company’s and Business Unit’s success by including compensation objectives reflecting a combination of corporate financial (25% weight) and business unit performance (75% weight). NEOs receive payouts based on the weighted average performance of all business unit plans, which resulted in a payout of 6.41% of base salary for 2018.

46 | CORNING2019 PROXY STATEMENT |

Table of Contents

Compensation Discussion & Analysis

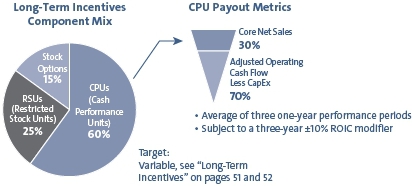

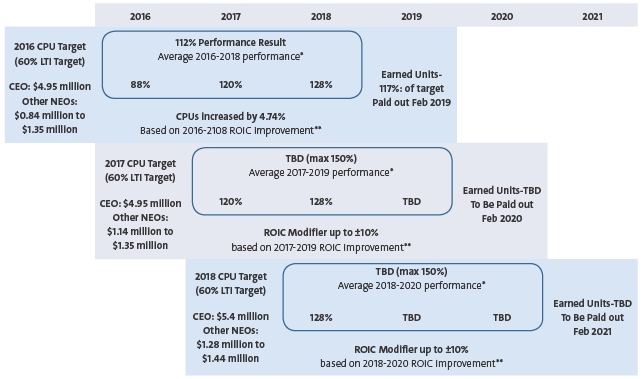

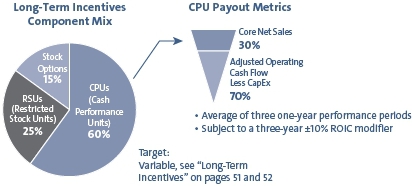

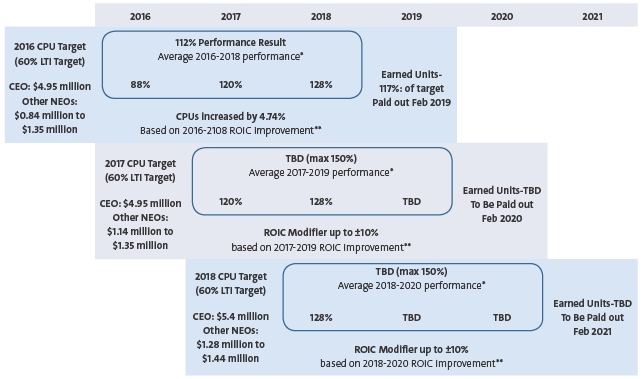

Our Long-Term Incentive (LTI) awards reflect our belief thatIncentives Beginning in 2020 and in response to shareholder feedback, we realigned the equity and cash flowsportions of LTI, reducing the portion of cash performance units from 60% to 25% and revenue growth enable investments that will sustain our growth overincreasing the long term and thatequity portion from 40% to 75%. With the interestsaddition of our executives and shareholders should be aligned.PSUs (and elimination of stock options) we also increased the overall portion of LTI tied to corporate financial performance from 60% to 70%. LTI awards are now comprised of 60%45% Performance Stock Units (PSUs), 25% Cash Performance Units (CPUs), 25% and 30% Restricted Stock Units (RSUs),. 2020 CPU and 15% Stock Options. CPUPSU awards are based 70% on Adjusted OperatingFree Cash Flow, less CapEx and 30% on Core Net Sales, averaged over a three-year performance period. In addition to the above measures, 2016metrics, CPUs and PSUs are subject to an ROIC modifier of up to +/-10% based on ROIC improvement over the three-year period 20162020 through 2018. We implemented this ROIC modifier2022 against pre-established objectives. Long-Term Incentives

(Paid in Cash and Equity) |  |

Responding to Shareholder Feedback in Concrete Ways Corning takes our shareholders’ feedback seriously. The chart below shows actions we have taken in response to feedback received during our shareholder engagement. | What we heard from shareholders… | How we responded… | | Shareholders liked the linkage ofour compensation programs to ourbusiness priorities | In 2019 we successfully completed the 2016-2019 Strategy & Capital Allocation Framework and implemented the ambitious 2020-2023 Strategy & Growth Framework to build on the success of the SCAF. While 2020 broughtunprecedented challenges to our end markets and operations driven bythe COVID-19 pandemic, economic uncertainty, and social unrest, Corningadapted rapidly and remained resilient. We executed well to preserve financialstrength, while advancing major innovations with industry leaders. As discussed on page 7, we successfully delivered on these priorities in 2020. | | Shareholders liked the 3-year +/- 10%ROIC modifier added to our executivelong-term incentive plan | In 2016 we introduced a three-year +/-10% ROIC modifier to the CPUs inour Long-Term Incentive Plan. A planned increase of the weighting of the three-year modifier to +/-25% was postponed in 2020 to focus on only the most prudent capital investments, and we instead retained the +/-10% modifier. We will revisit the increased modifier at a later date. | | Shareholders like the alignmentof executive compensation with their interests | Beginning in 2020, we decreased the cash component from 60% to 25% andincreased the equity component in our LTI Plan by 88% (from 40% to 75% of target) of an executive’s annual target opportunity, reducing the portion of LTI denominated in cash units. |

| 54 | CORNING 2021 PROXY STATEMENT |

Table of Contents Compensation Discussion & Analysis Impact of COVID-19 on Compensation and Benefits As the pandemic unfolded in the early part of 2020, it became clear that we had to take extraordinary steps to navigate the economic uncertainty, protect our financial health, and preserve the trust of Corning stakeholders, all while keeping employees safe and retaining our talent. To address these concerns, after initial discussions in April, our Compensation Committee approved certain actions under the Shared Sacrifice, Shared Opportunity (SSSO) program in May, effective June 1, 2020. Our actions were multi-faceted with the primary goals to ensure financial health and stability of the Company and retain the talent we would need as we returned to growth. These actions included the following: | • | Cancellation of our 2020 annual salary review cycle for our global salaried employees, ordinarily effective in July. | | | | • | Temporary reduction of work schedules and/or furloughed employees where appropriate. | | | | • | Temporary suspension of company matching in our Investment (401(k)) and Supplemental Investment Plans for U.S. salaried employees. | | | | • | Implementation of certain salary actions. |

| | | | • | A portion of base salary (40% for the CEO and non-employee Directors, 30% for other NEOs and executives, and 5% to 25% for approximately 10,000 other salaried employees) from the period June 1 through year-end was exchanged for options and restricted stock units vesting over three years. | | | | | • | 2020 cash PIP was cancelled and replaced with performance stock units for NEOs (PIP-PSUs) and RSUs for all other eligible employees. |

| • | The replacement equity awards vest over three years. | | • | For NEOs, the PIP-PSUs performance was based on 2020 core sales and core EPS performance goals capped at 100%. |

2020 Compensation Metrics and Results In 2020, our key compensation metrics were established to focus and align leadership to key priorities in light of the COVID-19 pandemic and our adjusted operating priorities: to keep the Company strong and positioned to emerge stronger, take care of our employees and communities, mobilize our capabilities against the virus and focus on execution and flexibility. We determined that our key performance metrics – core net sales, profitability (as measured by Core EPS) and a cash flow measure (as measured by adjusted free cash flow in 2020) – were still the appropriate performance measures in 2020. The metrics for PIP-PSUs remained core net sales (25% weight), and profitability (as measured by Core EPS) (75% weight) with results capped at 100% since the plan was lower year-over-year. Our long-term metrics for CPUs and the new 2020 PSUs continue to be focused on core net sales (30% weight) and adjusted free cash flow (70% weight) with a 3-year +/- 10% ROIC modifier. | Our Metrics and Why We Use Them | | | | | | | Core Earnings per Share (Core EPS): | | Adjusted Free Cash Flow: | | Core EPS is our key measure of profitability. Corning generally budgets for share repurchases in establishing its target Core EPS measures. Share repurchases were largely paused in 2020 and our Core EPS metric took this pause into account. | | Strong positive cash generation enables us to remain financially strong during periods of uncertainty and invest in future growth,sustain leadership and provide returns to shareholders. It also requires us to carefully manage our capital investments. | | Core Net Sales: | | Return on Invested Capital (ROIC): | | Retaining and growing core net sales - both organic through innovation and through acquisitions, remains critical to our short- and long-term success. | | We focus on ROIC because it reflects our ability to generate returns from the capital we have deployed in our operations. Earned CPUs and PSUs may be increased or decreased up to 10% based on Corning’s ROIC over the three-year performance period. |

| CORNING 2021 PROXY STATEMENT | 55 |

Table of Contents Compensation Discussion & Analysis 2020 GOALSETTING: | To avoid unintended compensation outcomes, we capped short-term measures for PIP-PSU awards at 100% and utilized a flat spot around target in our long-term incentive plan. |

Given the uncertainty created by the pandemic, the Committee carefully monitored the rapidly evolving economic and business situation in the first and second quarters of 2020 and approved the following performance measures. The maximum earned PIP-PSUs was capped at 100% of target. | | | | | 2020 SSSO

PIP-PSU Measures | | Long-Term Incentive 2020 CPU and PSU

(Year Three of 2018-2020 Plan) | | | | | | Core EPS Goal

(Weighted 75%) | | Core Net Sales Goal

(Weighted 25%) | | Adjusted Free Cash

Flow Goal

(Weighted 70%) | | Core Net Sales Goal

(Weighted 30%) | | | | Payout % | | Core

EPS

($) | | % of

2020

Plan | | Core Net

Sales

(in $M) | | % of

2020

Plan | | Adjusted

FCF

(in $M) | | % of

2020

Plan | | Core Net

Sales

(in $M) | | % of

2020

Plan | | | | 200% | | | | | | | | | | 1,000 | | 200 | | $11,600 | | 109.4 | | | | 150% | | Capped at 100% | | 700 | | 140 | | 11,200 | | 105.7 | | | | 125% | | | | | | | | | | 600 | | 120 | | 11,000 | | 103.8 | | TARGET | | 100% | | 1.21 | | 100 | | 10,600 | | 100.0 | | 500 | | 100 | | 10,600 | | 100.0 | | | | 75% | | 0.80 | | 66 | | 9,600 | | 90.6 | | 100 | | 20 | | 9,600 | | 90.6 | | | | 50% | | 0.72 | | 60 | | 9,400 | | 88.7 | | 50 | | 10 | | 9,400 | | 88.7 | | | | 0% | | 0.64 | | 53 | | 9,200 | | 86.8 | | 0 | | 0 | | 9,200 | | 86.8 |

ROIC Modifier In 2016, based on investor feedback, the Compensation Committee added a three-year ROIC modifier to the CPUs in our LTI Plan. With this modifier, the CPU payout may be increased or decreased up to 10% based on ROIC performance over the three-year performance period. For the 2018-2020 performance period, the ROIC improvement target was established at 100 basis points, which the Committee believed was challenging but achievable through continued strong operating performance. The setting of this target reflected the multi-year operating plan for the Company and in supportmanagement’s assessment of our Capital Allocation Framework. future Company performance. The ROIC modifier for 2018 CPUs (based on 2018 through 2020 performance) was as follows: ROIC Improvement

2018 – 2020

(in basis points) | Modifier (Adjustment to 2018 CPUs) | | 250 | +10% | | 175 | +5% | | 100 | No adjustment | | 50 | -5% | | 0 | -10% |

We define ROIC as core net income before interest, divided by invested capital. Core net income before interest is calculated using constant exchange rates for Japanese yen, NewSouth Korean won, Chinese yuan, new Taiwan dollar, and Chinese yuanthe euro against the U.S. dollar, and a constant tax rate.rate of 21%. Invested capital is the sum of total assets excluding foreign currency hedge assets less total liabilities excluding foreign currency hedge liabilities and debt. The 2020 Performance and Compensation Committee approved this ROIC modifier calculation in early 2016.Alignment The following table compares

In 2020, we responded effectively to a challenging year. Our response was focused on bolstering our financial strength—reducing production levels and operating costs, carefully managing inventory, reducing capital expenditures, and pausing share buybacks. While we took steps to adjust production, we didn’t reduce capacity, and as a result, we remained positioned to meet increasing demand as the 2018 actual results and targeted goals for each performance measure compared with 2017.economy improved. | | 2018 | | 2017 | | Measure | | Actual and

% increase

vs. ’17 Actual | | Target and

% increase

vs. ’17 Actual | | Actual | | Target | | Core EPS | | $1.78 | | $1.74 | | $1.60 | | $1.57 | | Percentage increase vs ’17 Actual | | +11.9% | | +8.8% | | | | | | Core Net Sales (millions) | | $11,398 | | $11,028 | | $10,258 | | $9,945 | | +11.5% | | +7.5% | | | | | | Adjusted Operating Cash Flow | | $926 | | $696 | | $816 | | $756 | | less CapEx (millions) | | N/A(1) | | N/A(1) | | | | |

(1)56 | Adjusted Operating Cash Flow less CapEx goals are established yearly, independent of the prior year.CORNING 2021 PROXY STATEMENT |

Please see “Our 2018 Performance Highlights” on page 6 for more information about our Core Performance Measures and Appendix A to this proxy statement for a reconciliation of the non-GAAP measures we use in this proxy statement to the most directly comparable GAAP financial measures. In 2018, Corning used constant currency rates for the Japanese yen of ¥107:$1, for the New Taiwan dollar of NT$31:$1, for the Chinese yuan of ¥6.7:$1 and for the South Korean won of ₩1,175:$1, and restated all prior periods to these constant currency rates for comparability purposes. For additional information about our Core Performance Measures, please see page 6.

Our rigorous goal setting process is demonstrated by the following payout scale for our short- and long-term incentive plans:

| | | | Short Term/Annual Incentive

2018 PIP Measures | | Long-Term Incentive

2018 CPU Measures

(Year Three of 2016-2018 Plan) | | | | | Core EPS Goal

(Weighted 75%) | | Core Net Sales Goal

(Weighted 25%) | | Adjusted Operating Cash

Flow less CapEx Goal (Weighted 70%) | | Core Net Sales Goal

(Weighted 30%) | | | Payout % | | Core

EPS | | Growth

(over

prior year) | | Core Net

Sales

(in $M) | | Growth

(over

prior year) | | Adjusted

OCF less

CapEx (in $M) | | % of

2018 Plan | | Core Net

Sales

(in $M) | | % of

2017

Core Net

Sales | | | 200% | | $1.96 | | 22.8% | | $11,490 | | 12.0% | | Capped at 150% | | | 150% | | 1.89 | | 18.6% | | 11,387 | | 11.0% | | $1,096 | | 157.5% | | $11,490 | | 12.0% | | | 125% | | 1.81 | | 13.4% | | 11,205 | | 9.2% | | 896 | | 128.7% | | 11,387 | | 11.0% | | TARGET | | 100% | | 1.74 | | 9.4% | | 11,028 | | 7.5% | | 696 | | 100.0% | | 11,028 | | 7.5% | | | 75% | | 1.64 | | 2.7% | | 10,601 | | 3.3% | | 496 | | 71.3% | | 10,601 | | 3.3% | | | 50% | | 1.60 | | 0.5% | | 10,387 | | 1.3% | | 429 | | 61.7% | | 10,387 | | 1.3% | | | 0% | | 1.42 | | -10.7% | | 10,054 | | -2.0% | | 296 | | 42.5% | | 10,054 | | -2.0% |

CORNING2019 PROXY STATEMENT | 47 |

Table of Contents

Compensation Discussion & Analysis

ROIC Modifier

In 2016, based on investor feedback and in support of our Capital Allocation Framework, the Compensation Committee added a three-year ROIC modifier to CPUs. With this modifier, the CPU payout may be increased or decreased up to 10% based on ROIC performance over the three-year performance period. For the 2016-2018 performance period, the ROIC target was established at 250 basis points, which the Committee believed was challenging but achievable through continued strong operating performance. The setting of this target reflected the multi-year operating plan for the company and management’s assessment of future Company performance. The ROIC modifier for 2016 CPUs (based on 2016 through 2018 performance) was as follows:

ROIC Improvement

2016 – 2018

(in basis points) | | Modifier (Adjustment to 2016 CPUs) | | 250 | | +10% | | 175 | | +5% | | 100 | | No adjustment | | 50 | | -5% | | 0 | | -10% |

From 2016 to 2018, ROIC improved 174 basis points, resulting in a +4.74% increase to the 2016 CPU payout made in 2019.

Results for Short Term Incentives and the 2016-2018 LTI Plan

| Short Term Incentives | PERFORMANCE INCENTIVE PLAN (PIP)

100% CORPORATE FINANCIAL PERFORMANCE | | Components | | Weighting | | % of target

earned | | Core EPS | | 75% | | 116% | | Core Net Sales | | 25% | | 155% | | 2018 performance result | | | | 126% | | | GOALSHARING – 25% CORPORATE PERFORMANCE,

75% BUSINESS UNIT PERFORMANCE | | Components | | | | % of base

salary earned | | Corporate financial performance — | | | | | | 1.25% target × 126% performance | | | | | | (See PIP above) | | 25% | | 1.58% | | Average Business Unit Performance | | 75% | | 4.83% | | 2018 performance result | | | | 6.41% |

| Long Term Incentives | CASH PERFORMANCE UNITS

(60% OF LTI TARGET – OTHER 40% ARE RSUs AND OPTIONS) | | Components | | Weighting | | % of target

earned, 2018

performance

year | | Operating Cash Flow less CapEx | | 70% | | 128% | | Core Net Sales | | 30% | | 127% | | 2018 performance result | | | | 128% | | | | 2016-2018 CPU PERFORMANCE RESULTS | | Components | | | | % of target

earned,

2016-2018

performance | | 2016 performance result | | | | 88% | | 2017 performance result | | | | 120% | | 2018 performance result | | | | 128% | | 2016-2018 average performance | | | | 112% |

ROIC MODIFIER | 2016-2018 average performance | × | ROIC Modifier | = | Final percentage of target amount of 2016 CPUs to be paid in 2018 | 112% × 4.74% =117% |

48 | CORNING2019 PROXY STATEMENT |

Table of Contents Compensation Discussion & Analysis Total Shareholder Return

Corning’s Total Shareholder Return (TSR),Our first-half actions generated significant cost savings in the second half of the year. And as the economy improved, we effectively adjusted operations, keeping pace as demand started to recover in many of the markets we serve. Our results tell the story.

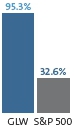

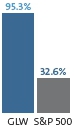

See page 7 for more performance highlights and accomplishments. The following table compares our 2020 actual results with our targeted goals for each performance measure compared with 2019 in which consists of stock price appreciation and reinvestment of common dividends, outperformed the S&P 500 Index over the last 1-, 3-, and 5-year periods as of year-end 2018. Since the introduction of our Strategy and Capital Allocation Framework, we have outperformed the S&P 500 Index by nearly three times in terms of total shareholder return.performance results were substantially below target. | | | 2020 | | 2019 | | Measure | | Actual and

% increase

vs. ’19 Actual | | Target and

% increase

vs. ’19 Actual | | Actual | | Target | | Core EPS | | 1.43(1) | | $1.21 | | $1.76 | | $1.96 | | Percentage increase vs ’19 Actual | | -18.8% | | -31.3% | | | | | | Core Net Sales (millions) | | $11,258(1) | | $10,600 | | $11,656 | | $12,298 | | | -3.4% | | -9.1% | | | | | | Adjusted Free Cash Flow (millions) | | $932(1) | | $500 | | N/A(2) | | N/A(2) |

The Strategy(1) | Figures exclude the impact of the HSG consolidation. | | | | (2) | 2019 Cash Flow goals are adjusted operating cash flow and Capital Allocation Framework has paid off fromcapital expenditures. |

Please see page 8 for more information about our Core Performance Measures and Appendix A for a reconciliation of the non-GAAP measures to the most directly comparable GAAP financial measures. In 2019, we set aggressive growth goals and did not achieve all of them, resulting in 2019 performance results that were well below target for compensation purposes. In 2020, our international operations — particularly a financial perspective.

Between its inceptionnew Display plant coming online in October 2015Wuhan, China — provided us with early visibility to the impact of the COVID-19 pandemic. We were able to respond nimbly and year-end 2018, Corning had TSR of approximately

95% vs. less than 35%effectively to a challenging year. We successfully executed against our priorities, overcoming challenges and driving growth. Despite the pandemic, we successfully grew core net sales each quarter as the year progressed and generated significant cash for the S&P 500.balance sheet to preserve flexibility in uncertain times, which resulted in above-target compensation performance results. |

ANNUALIZED TOTAL SHAREHOLDER RETURNPAY FOR PERFORMANCE RESULTS

| | TOTAL SHAREHOLDER RETURN SINCE START OF FRAMEWORK | As of year-end 2018 | | October 21, 2015 through year-end 2018 |  | |  | Source: Bloomberg

| | Source: Bloomberg

|

Shareholder Engagement

| | 2020 | | 2019 | | PIP-PSUs (capped at 100% of target) in 2020, cash PIP in 2019 | 100% | | 24% | | Goalsharing payout (vs. 5% target) | 6.84% | | 4.37% | | 2020 CPU and PSU performance result (% of target) | 181% | | 62% | | 3-year CPU ROIC modifier (+/- up to 10%) | -10% | | -2.8% | | 3-year performance results ending in the year (including modifier) | 112% | | 100% |

| CORNING 2021 PROXY STATEMENT | 57 |

At our 2018 annual meeting of shareholders, our Say on Pay proposal received support from | 90% | of votes cast. |

Table of Contents Compensation Discussion & Analysis Shareholder Engagement

Strong Say on Pay Results.At our 20182020 Annual Meeting of shareholders, our Say on Pay proposal received support from 90%92% of votes cast. We have received 90% or greateran average of 92% support for our Say on Pay proposal eachover of the past three years. We view this level of shareholder support as an affirmation of our current pay practices and pay for performance philosophy.

Shareholder Outreach.In Shareholder Outreach.In 2018, as part of our shareholder outreach program,2020, we met with shareholders representing approximately 45%40% of our outstanding shares, and approximately two-thirds60% of our top fifty50 largest shareholders. In these meetings, we discussedAdditionally, executive management, Board members, Investor Relations and the Corporate Secretary engage annually with the governance teams of our Strategylargest investors to understand their perspectives on a variety of matters, including executive compensation, risk oversight, corporate governance policies and Capital Allocation Framework (SCAF), as well as governance, compensation, human capital management andcorporate sustainability matters.practices. We learned through these meetingsthatmeetings that our investors areapproved of our COVID-19 pandemic response and continue to be pleased with the SCAF and believe we have clearly articulated how it creates shareholder value and is connected to management compensation at Corning.our strategic priorities. These shareholders also were generally supportive of our executive compensation program, the direct linkage of financial metrics in our performance-based variable compensation plans to the SCAF,our strategic priorities, and the additiondecrease in the cash percentage/increase in the equity percentage of the ROIC modifier that was implemented in 2016 in response to investor feedback.our Long-Term Incentive Program. As in previous years, shareholders were not prescriptive about compensation plan design. Instead, they were more interested to see that the results and outcomes delivered by the incentive plans were aligned appropriately with Corning’s performance and had appropriately incented our executives to deliver on our SCAF.strategic priorities.

We also communicate with shareholders through a number of routine forums, including quarterly earnings presentations, SEC filings, this Proxy Statement, our online Annual Report, Diversity and Inclusion Report, the annual shareholder meeting, investor meetings and conferences and web communications. We relay shareholder feedback and trends on corporate governance and sustainability developments to our Board and its Committees and work with them to both enhance our practices and improve our disclosures.

CORNING2019 PROXY STATEMENT | 49 |

Table of Contents

Compensation Discussion & Analysis

Robust Compensation Program Governance | | | Corning has rigorous and robust governance with respect to its executive compensation plan: ✓

| | | |  Close alignment of pay with performance over both the Close alignment of pay with performance over both the shortshort- and long-term horizon, and delivery of the goals of our Strategy and Capital Allocation Framework

✓strategic priorities Mix of cash and equity incentives tied to short-term financial performance and long-term value creation Mix of cash and equity incentives tied to short-term financial performance and long-term value creation

✓ CEO total compensation targeted within a competitive range of the Compensation Peer Group median CEO total compensation targeted within a competitive range of the Compensation Peer Group median

✓ Caps on payout levels for annual incentives in a budgeted down-cycle year Caps on payout levels for annual incentives in a budgeted down-cycle year

✓ Significant NEO share ownership requirements Significant NEO share ownership requirements

✓ Anti-hedging and pledging policies Anti-hedging and pledging policies

✓ Clawback policy applicable to both cash and equity compensation Clawback policy applicable to both cash and equity compensation

✓ Minimum 3-year vesting period for restricted stock or restricted stock unit awards in employee equity plan Minimum 3-year vesting period for restricted stock or restricted stock unit awards in employee equity plan

✓

| |  Independent compensation consultant advisor to the Compensation Committee Independent compensation consultant advisor to the Compensation Committee

✓ History of demonstrated responsiveness to shareholder concerns and feedback, and ongoing commitment to shareholder engagement History of demonstrated responsiveness to shareholder concerns and feedback, and ongoing commitment to shareholder engagement

✓ Limited and modest perquisites that have a sound benefit to the Company’s business Limited and modest perquisites that have a sound benefit to the Company’s business

✕ No tax gross-ups or tax assistance on perquisites No tax gross-ups or tax assistance on perquisites

✕ No repricing or cash buyout of underwater stock options without shareholder approval No repricing or cash buyout of underwater stock options without shareholder approval

✕ No excise tax gross-ups for officer agreements entered into after July 2004 No excise tax gross-ups for officer agreements entered into after July 2004

|

| 58 | CORNING 2021 PROXY STATEMENT |

Table of Contents2018 Compensation Discussion & Analysis 2020 Executive Compensation Program Details Our key compensation program principles are as follows: ●• | Provide a competitive base salary | | | | ●• | Pay for performance | | | | ● | Incent execution of our Strategy and Capital Allocation Framework | | | ●• | Apply a team-based management approach | | | | ●• | Increase the proportion of performance-based incentive compensation for more senior positions | | | | ●• | Align the interests of our executive group with shareholders |

As stated in “Impact of COVID-19 on Compensation and Benefits” on page 55 above, in 2020 we took certain compensation actions to retain cash while preserving talent during a period of great uncertainty. Despite these actions, our core compensation philosophy and program details remain the same. Base Salary Base salaries provide a form of fixed compensation and are reviewed annually by the Committee, which considers internal equity and individual performance, as well as competitive positioning, as discussed in the “Compensation Peer Group” section starting on page 54.63. In 2018,2020, as part of our SSSO response to COVID-19, Mr. Weeks’ base salary increasedwas temporarily reduced by 3%40%, consistent with the salary increase budgetfrom June 1, 2020 through December 27, 2020 in exchange for a one-time grant of RSUs and stock options vesting over three years. Other salaried employees’ reductions varied by pay grade from 5% to 30% for executives (including all of our other U.S. salaried employees. Mr. Tripeny received a base salary increase of 15% as part of a multi-year strategy to better align his overall compensation package to comparable external salary benchmarks as he continues to demonstrate strong performance as CFO. Base salaries of the remaining NEOs increased by 5.5% as a result of strong performance and to align compensation with both internal and external salary benchmarks as the Company grows. 50 | CORNING2019 PROXY STATEMENT |

Table of ContentsNEOs).

Compensation Discussion & Analysis

Short-Term Incentives Short-term incentives are designed to reward NEOs for Corning’s consolidated annual financial performance supporting our Strategy and Capital Allocation Frameworkstrategic priorities and team-based management approach. Corning has two short-term incentive plans: the Performance Incentive Plan (PIP) and GoalSharing. PIP targets are individually established by the Committee each February as a percentage of the NEO’s year-end salary depending on the competitive marketplace and his or her level of experience. In 2018,2020, Mr. Weeks’ PIP target iswas unchanged at 150% of year-end base salary. Mr. Musser’s PIP target was established at 90% of year-end base salary based on his promotion to President and Chief Operating Officer, Mr. McRae’s PIP target iswas unchanged at 85% of year-end base salary and other NEOs haveMessrs. Tripeny and Clappin had unchanged PIP targets of 80%. As described above in “Impact of COVID-19 on Compensation and Benefits,” 2020 cash PIP goals are approved in Februarywas canceled and payments are made by the following March 15 once the performance results are known. As outlined on page 48, the 2018 PIP payout will be 126%exchanged for a grant of target based on performance achievement above the pre-established targets.PSUs (PIP-PSUs) for NEOs which were capped at 100%. GoalSharing is designed to motivate employees to work together to achieve the most critical goals in each business unit. All Corning employees are eligible for GoalSharing with a target generally equal to 5% of base salary. Earned GoalSharing may be 0% - 10% of base salary, and is weighted 25% on corporate financial performance and 75% on business unit performance. As a result of the pandemic, 2020 Business Unit plans (75% weight) were updated to align employees to the key priorities of the business unit in light of the pandemic. The corporate component (25% weight) was earned at 125% of target (1.56% of base salary) in recognition of the strong second-half performance. NEOs’ GoalSharing is based 25% on corporate financial performance and 75% on the average of the results of all business unit plans. GoalSharing goals are approved Long-Term Incentives Beginning in February each year and payment are made by the end of the following February once the performance results are known. As outlined on page 48, the 2018 GoalSharing payout will be 6.41% of year-end base pay due to achievement above the pre-established targets. Long-Term Incentives

2020, Long-Term Incentives (LTI) are comprisedwere realigned. The portion of LTI provided in cash was reduced from 60% to 25% and the portion of LTI delivered in equity in the formwas increased from 40% to 75%. Stock options were eliminated and PSUs were added with PSUs comprising 45% of CPUs,LTI target and RSUs and stock options (Options)comprising 30% of target. The total portion of LTI tied to corporate financial performance increased from 60% to 70%. We believe it is important to link LTI amountsmetrics to financial measures that supportwill drive the executionsuccess of our Strategy and Capital Allocation Frameworkstrategic priorities and generate long-term value for our shareholders. We also believe it is important for a significant portion of LTI to be in the form of equity to align our executives’ stock ownership interests with those of our shareholders. | CORNING 2021 PROXY STATEMENT | 59 |

Table of Contents Compensation Discussion & Analysis LTI targets are established by the Committee for each NEO annually in February. Mr. Weeks’ 20182020 LTI target is $9was unchanged at $9.75 million. Other NEOs’ targets may be found in footnote 3 to the Summary Compensation Table on page 5867 and range from $2.125$2.35 million to $2.4$2.925 million. ●• | PSUs and CPUsrepresent 60%45% and 25% of the annual target LTI target.value, respectively. Payout is based on cash generation and revenue growth, growth—measures that support our Strategy and Capital Allocation Framework as well as our long-term financial health and success. The 2020 performance measures for PSUs and CPUs are are: 1) Adjusted OperatingFree Cash Flow less CapEx (70%), which alignsfocuses on generating cash to ensure the cash flow goalcompany’s financial stability in uncertain times and to our capital allocation planallow for investment in innovation and maintains focus on our CapEx,future growth, and 2) Core Net Sales (30%). which focuses on growth | | | | Actual CPUs and PSUs earned are based on the averageactual performance averaged over a three-year period. CPUs awarded in 2018 are alsoperiod, and subject to a three-year ROIC modifier of up to ±10% to further align compensation earned withemphasize the goalimportance of our Strategyprudent capital investments. CPUs and Capital Allocation Framework to improve our corporate ROIC. Accordingly, CPUsPSUs earned for the years 2018-20202020-2022 will be vested and released (in the case of PSUs) and paid out (in 2021) subjectthe case of CPUs) in 2023 based on pre-established performance goals. In our 2020 proxy statement, we had discussed a plan to an adjustmentincrease the weighting of up to ±10%, depending on Corning’s ROIC performance over the three-year modifier from ±10% to ±25% and add additional performance period comparedmeasures tied to a pre-established performance target.the Strategy and Growth Framework. Due to the economic uncertainty caused by the COVID-19 pandemic, we did not change the weighting for the modifier or additional goals during 2020. We wanted to maintain the primary focus on ROIC which requires careful consideration on capital expenditures during the economic uncertainty brought on by the pandemic. Our intent is to again consider increasing the modifier and adding additional measures as we reconsider our strategic priorities once the uncertainties surrounding the pandemic have subsided. | | | | ●• | RSUsrepresent 25%30% of the annual target LTI value. The number of RSUs granted is determined based on the closing stock price on the first business day of April, and awards cliff vest approximately three years from the grant date. | | | ● | Optionsrepresent 15% of the annual target LTI value. The number of Options granted is determined using a Black-Scholes valuation. Options were granted on the first business day of April. Vesting is three years after the grant date, and the option awards have a maximum ten-year term. |

CORNING2019 PROXY STATEMENT | 51 |

Table of Contents

Compensation Discussion & Analysis2018 – 2020 CPUs and 2020 PSUs — Our 3-Year Performance Period Measurements

Long-Term Incentives – Cash Component

| * | Performance targets are generally established in February each year for the calendar year. In 2020, due to disruptions related to the COVID-19 pandemic, performance targets were established in July 2020. See page 48pages 55 and 56 for 20182020 performance measures and results | | | | ** | 3-year ROIC improvement target is established at the beginning of each 3-year performance period. See page 48pages 55 and 56 for 2016-20182018-2020 performance measuremeasures and results |

2018 Long-Term Incentives – Equity Components

60 | Compensation

Component | Target

Opportunity | Number of

Units/Options Granted | Vesting

Period | Value

Realized | Restricted

Stock

Units (RSUs) | CEO:

$2.25 million

Other NEOs:

$0.53 million to

$0.6 million

| 25% of LTI target, based on the closing price of Corning’s common stock on the grant date (April 2, 2018) | Approximately

3 years | Dependent upon Corning common stock price on the vesting date | Stock

Options | CEO:

$1.35 million

Other NEOs:

$0. 32 million to

$0.36 million

| 15% of LTI target, based on the Black Scholes Valuation at the time of the grant (April 2, 2018) | 3 years | Dependent upon Corning common stock price increase, if any, between time of the grant and the time of exerciseCORNING 2021 PROXY STATEMENT |

52 | CORNING2019 PROXY STATEMENT |

Table of Contents Compensation Discussion & Analysis

2020 Long-Term Incentives – Equity Components  | Compensation

Component | Number of

Units Granted | Vesting

Period | Value

Realized | | Performance Stock Units(PSUs) | 45% of LTI Target, based onthe closing price of Corning’scommon stock on the grantdate (April 1, 2020) | 3 years | Dependent on performanceagainst pre-establishedmetrics (see the CPU/PSUchart above) and Corningcommon stock price on thevesting date | | Restricted StockUnits (RSUs) | 30% of LTI target, based onthe closing price of Corning’scommon stock on the grantdate (April 1, 2020) | 3 years | Dependent upon Corningcommon stock price on thevesting date |

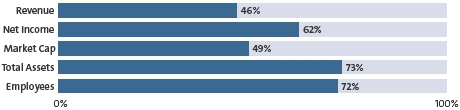

CEO Target Compensation Over the past fourteensixteen years, under the leadership of Mr. Weeks, Corning has grown significantly, achieved the lowest cost position and market leadership in many key businesses, and created new-to-the-world product categories, such as Corning® Gorilla® Glass, heavy-duty diesel substrates and filters, customized fiber-to-the-home solutions and Corning Valor® Glass. Based on this sustained level

In 2020, Mr. Weeks’ significant experience and tenure as a CEO was of performance, in February 2018,particular value to the Compensation Committee approved a 3% base salary increase forcompany and its Directors, having successfully steered the company through other periods of significant uncertainty. Mr. Weeks was personally involved in all aspects of the company’s response to the COVID-19 pandemic. He and an increasethe senior leadership team successfully refocused the Company, which resulted in LTIreturn to growth in the second half of the year and maintenance of a strong balance sheet throughout the year. In the second half, we improved core net sales 24% over the first half while expanding core operating margin 122%, returning to year-over-year growth, and generating very strong free cash flow. For the year, we generated almost a billion dollars of free cash flow, and our balance sheet remains very strong. In 2020 Mr. Weeks’ target to $9 million.compensation was not changed, and Mr. Weeks participated in the SSSO program along with other employees and executives: ●• | Base salary– increased by 3%The annual salary review that would ordinarily be effective in line withJuly was canceled and Mr. Weeks’ base salary increaseswas reduced by 40% for all other U.S. based salaried employees.the period June 1 through December 27 in exchange for options and RSUs vesting over the next three years | ● | | | • | Short-Term Incentives – 2020 cash PIP (150% of base at target) was cancelled and replaced with PIP-PSUs based on pre-established performance goals, capped at 100%, and subject to a three-year vesting period. GoalSharing remained unchanged (target of 5% of base) | | | | • | Long-Term Incentives Target–remained flat at 155%$9.75 million, and the mix was realigned as described on page 54, with 70% of base salary, comprised of a PIP target of 150% of base salary and a GoalSharing target of 5% of base salary. | ● | Long-Term Incentives Target– increased to $9 million from $8.25 millionbased on average performance over the three-year performance period |

Eighty-nine percent of Mr. Weeks’ pay is directly tied to Corning’s operating performance andor stock price. 2020 PIP PSUs were earned at 100% of target, though the value ultimately realized by Mr. Weeks will continue to be impacted by changes in Corning stock price and will vest over 3 years. The 2020 performance factor for PSU and CPU awards attributable to 2020 performance was 181% of target, though the final payout factor for 2020 PSU and CPU awards is not yet known and remains subject to performance outcomes versus pre-defined goals during 2021 and 2022 and a three-year ROIC modifier. Mr. Weeks’ 2018 CPU award covering the 2018 to 2020 performance period was completed and paid at 112% of target. | CORNING 2021 PROXY STATEMENT | 61 |

Table of Contents Compensation Discussion & Analysis The target mix for Mr. Weeks’ 2020 LTI awards was: 45% PSUs, 25% CPUs and 30% RSUs. In contrast, the target mix for Mr. Weeks’ 2019 LTI awards was: 60% CPUs, 15% stock options and 25% RSUs. This reflected an 88% increase to the equity portion of target LTI awards (from 40% to 75% of target), a significant decrease in the cash portion of target LTI from 60% to 25%, and a 17% increase (from 60% to 70% of target) to the portion of LTI where payout is based on performance of financial goals over a 3-year period. | These program-based changes implemented in response to shareholder feedback, along with the SSSO-related base salary actions, significantly complicate year-over-year comparisons (2020 versus 2019) of Mr. Weeks’ total pay, as shown in the Summary Compensation Table with no change in target compensation from 2019 to 2020. |

For example, for PSUs, the target grant date value is disclosed in the year of grant, but for CPUs no value is disclosed until the payout factor is known, at which time the actual payout amount is shown. Nonetheless pay was aligned with performance in both years with significant under-performance in 2019 and above-target performance in 2020. Employee Benefits and Perquisites

Employee Benefits:Our NEOs are eligible to participate in the same employee benefits plans as all other eligible U.S. salaried employees. These plans include medical, dental, life insurance, disability, matching gifts, qualified defined benefit and defined contribution plans. We also maintain non-qualified defined benefit and defined contribution retirement and long-term disability plans with the same general features and benefits as our qualified plans for all U.S. salaried employees affected by tax law compensation, contribution or deduction limits. In addition to the standard benefits available to all eligible U.S. salaried employees, the NEOs are eligible for the benefits and perquisites described in this section.

Executive Supplemental Pension Plan (ESPP):We maintain an ESPP to reward and retain long-serving individuals who are critical to executing Corning’s innovation strategy. Our non-qualified ESPP covers approximately 2026 active participants, including all of the NEOs. In 2006, we capped the percentage of cash compensation earned as a retirement benefit under the ESPP at a maximum of 50% of final average pay for 25 or more years of service, a change that applies to all the NEOs except Dr. Morse.NEOs. The definition of pay used to determine benefits includes base salary and annual cash bonuses. Long-term cash or equity incentives are not included and do not affect retirement benefits. Executives must have at least ten years of service to be vested under this plan. All of the NEOs meet the ten-year vesting requirement. While we seek to maintain well-funded qualified retirement plans, we do not fund our non-qualified retirement plans. For additional details of the ESPP benefits and plan features, please refer to the section entitled “Retirement Plans” on page 64.76.

Executive Physical and Wellness:All executives are eligible for an annual physical exam in addition to wellness programs sponsored by Corning for all employees. The cost of the physical is imputed income to the executive.

Relocation and Expatriate-Related Expenses:As part of our global mobility program, our policies provide that employees who relocate to another country at our request are eligible for certain relocation and expatriate benefits to facilitate the transition and international assignment. These benefits include moving expenses, allowances for housing and goods and services, and tax assistance. These policies are intended to recognize and compensate employees for incremental costs incurred with moving or with living and working outside of the employee’s home country. The goal of these relocation and expatriate assistance programs is to ensure that employees are not financially advantaged or disadvantaged because of their relocation and/or international assignment, including related taxes. In July 2016, Mr. Clappin’s assignment in Tokyo ended and he relocated back to Corning, NY. Mr. Musser’s assignment to Shanghai, China ended in 2014 and he relocated back to Corning, NY. While he was basedon assignment in Tokyo, Mr.Japan and China Messrs. Clappin wasand Musser were eligible for expatriate benefits.benefits afforded to all expats on temporary international assignments. Tax-related assistance extends for several years beyond the assignment end due to LTI amounts earned while on assignment which vest after the assignment end date and settlement of taxes. These amounts are detailed in footnote 5, section (v) to the Summary Compensation Table. | 62 | CORNING 2021 PROXY STATEMENT |

CORNING2019 PROXY STATEMENT | 53 |

Table of Contents Compensation Discussion & Analysis